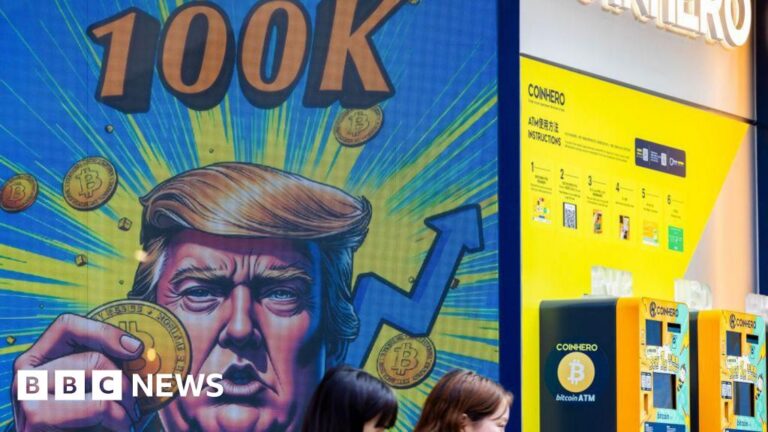

Bitcoin’s price has blasted through the much-anticipated threshold of $100,000, raising questions about how much higher it could go – and whether it can shake off its notorious volatility.

The world’s largest cryptocurrency rose to around $103,400 shortly after 04:00 GMT on Thursday, before falling slightly.

Dan Coatsworth, investment analyst at AJ Bell, described it as a “magic moment” for the cryptocurrency and said it had a “clear link” to Donald Trump’s election victory.

Trump took to social media to celebrate the milestone, posting “congratulations Bitcoiners” and “you’re welcome!”

The president-elect had previously pledged to make the US the “crypto capital” and “Bitcoin superpower” of the world, helping to push Bitcoin’s price higher once he was elected president.

It broke through the $100k barrier after Trump said he would nominate former Securities and Exchange Commission (SEC) commissioner Paul Atkins to run the Wall Street regulator.

Mr Atkins is seen as being far more pro-cryptocurrency than the current head, Gary Gensler.

“Clearly there is anticipation that the new administration is going to be somewhat more favourable to crypto than the old administration was,” said Andrew O’Neill, digital assets expert at S&P Global.

“So for the price of Bitcoin, I think that that’s what’s driven the trend so far [and it will] likely continue into the new year,” he added.

However, Bitcoin has a history of sharp falls as well as rapid rises – and some analysts have cautioned that is unlikely to change.

“A lot of people have got rich from the cryptocurrency soaring in value this year, but this high-risk asset isn’t suitable for everyone,” said Mr Coatsworth.

“It’s volatile, unpredictable and is driven by speculation, none of which makes for a sleep-at-night investment.”

During the US presidential election campaign, Trump sought to appeal to cryptocurrency investors with a promise to sack Gary Gensler – chair of the US financial regulator the Securities and Exchange Commission (SEC) – on “day one” of his presidency.

Mr Gensler’s approach to the cryptocurrency sector has been decidedly less friendly than Trump’s.

He told the BBC in September it was an industry “rife with fraud and hucksters and grifters”.

Under his leadership, the SEC brought a record 46 crypto-related enforcement actions against firms in 2023.

Mr Gensler said in November he would step down on 20 January – the day of Trump’s inauguration.

The choice of Paul Atkins to replace him at the helm of the SEC has been welcomed by crypto advocates.

Mike Novogratz, founder and chief executive of US crypto firm Galaxy Digital said he hoped the “clearer regulatory path” would now accelerate the digital currency ecosystem’s entry into “the financial mainstream.”

Bitcoin has seen fewer drastic falls in value during 2024 than in previous years.

In 2022 its price fell sharply below $16,000 after crypto exchange FTX collapsed into bankruptcy.

A number of key events besides Trump’s victory in the election have helped boost investor confidence that its value will keep going up.

The SEC approved several spot Bitcoin exchange traded funds (ETFs) allowing giant investment firms like Blackrock, Fidelity and Grayscale to sell products based on the price of Bitcoin.

Some of these products have seen billions of dollars in cash inflows.

But its potential to suddenly plummet in value serves as a reminder that it is not like orthodox currencies – and investors have no protection or recourse if they lose money on Bitcoin investments.

Carol Alexander, professor of finance at Sussex University, told BBC News that fear of missing out (FOMO) among younger people will see Bitcoin’s price continue to rise.

But she added that while this could spark a rise in other cryptocurrencies, many of the younger investors investing in meme coins are losing money.

Kathleen Breitman, co-founder of another cryptocurrency – Tezos – also had a word of caution for those tempted to invest in Bitcoin.

“These are markets that tend to move on momentum so you need to be extraordinarily cautious with it,” she told the BBC.